Tranche 2 AML/CTF Compliance for Accountants and Tax Agents

Meet your current TPB requirements and be Tranche 2 ready now:

Are you still receiving or storing sensitive identity documents?

Join the hundreds of accounting practices already benefiting from VerifiMe!

Accountants’ Single-Step Solution For TPB and Tranche 2

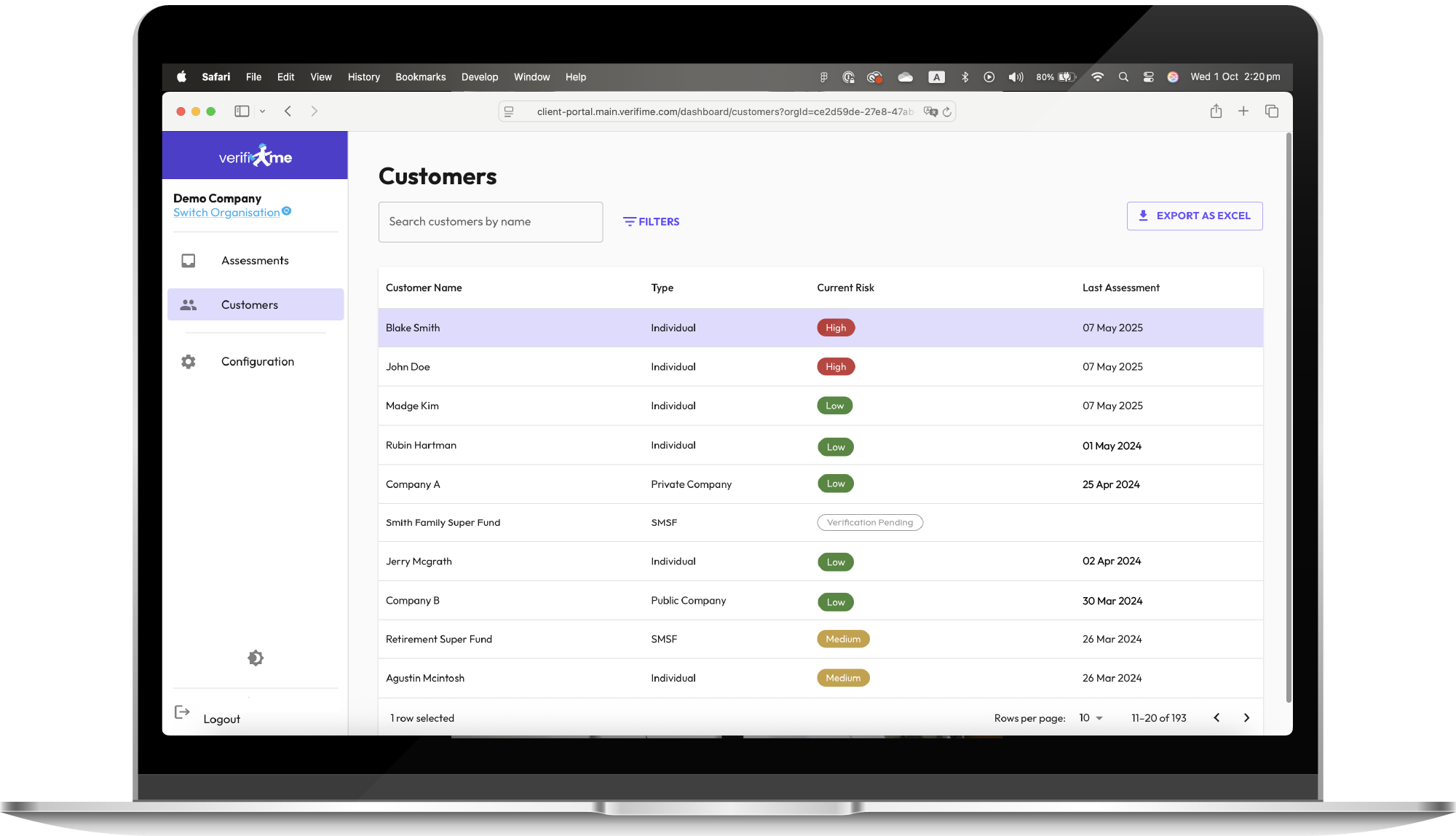

Let VerifiMe safely handle personally identifiable information for your customer due diligence

Meet the needs of TPB (PN) 5/2022

Be Tranche 2 ready for AML/CTF compliance

Build trust with customers

Save on processing time

Reduce your data handling risk

Why should accounting firms choose VerifiMe®?

Benefits to Accountants:

✅ Software as a service with no software downloads

✅ Configurable rules for tailored compliance

✅ Data security with no need to handle PII

✅ Streamlined individual or organisational identity verification

✅ Real time monitoring of AML & KYC compliance means you will be Tranche 2 ready

✅ No lock-in contracts or upfront ongoing payments

Benefits to Customers:

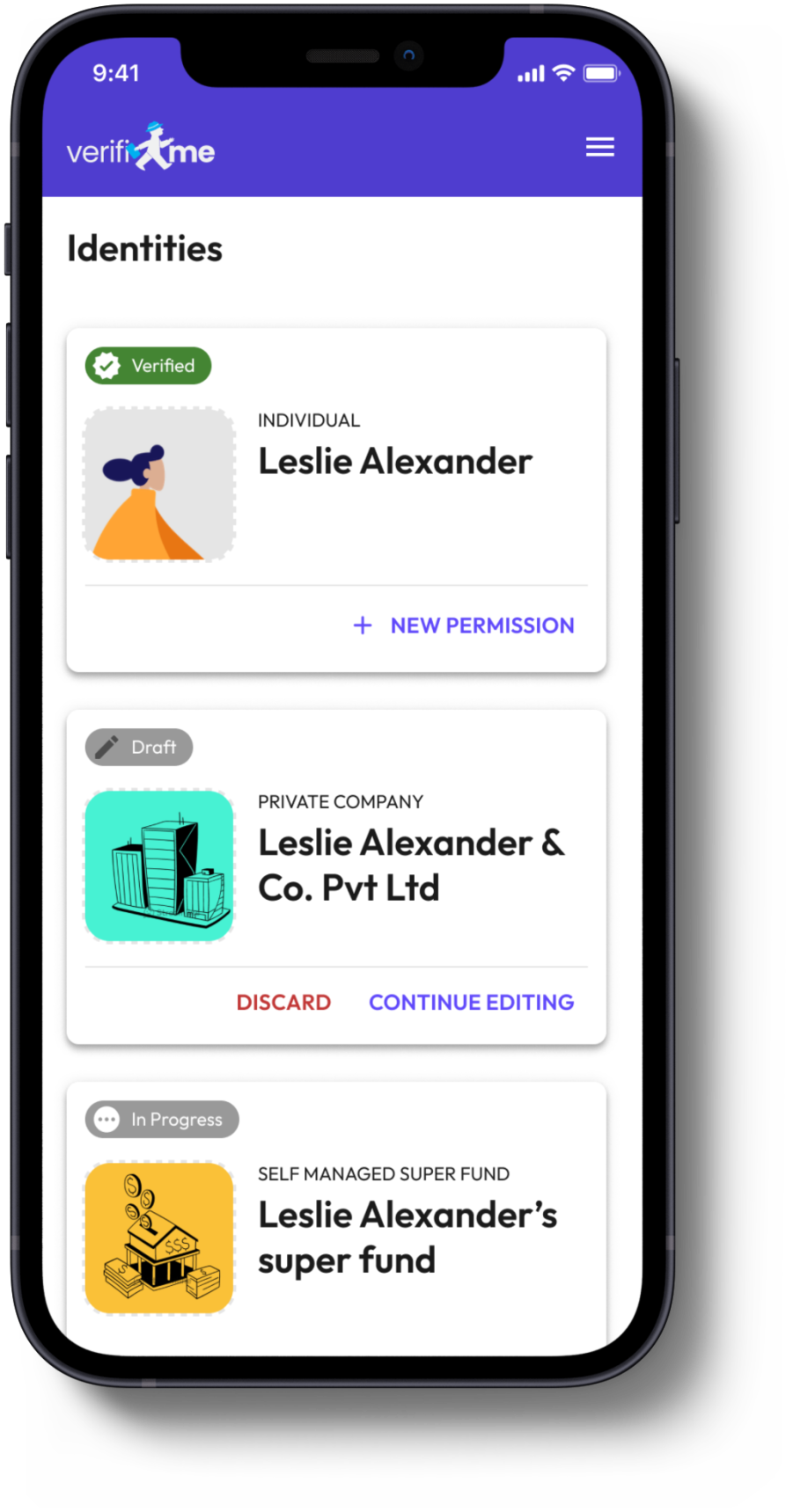

✅ A single digital ID wallet to store all legal entity credentials

✅ Upload and verify once, bring an end to the repetition with a shareable identity solution

✅ Retain control over sharing personal data with permissions

✅ Free to set up and use

VerifiMe Solution for Tranche 2 Entities. Start now with 3 Steps

-

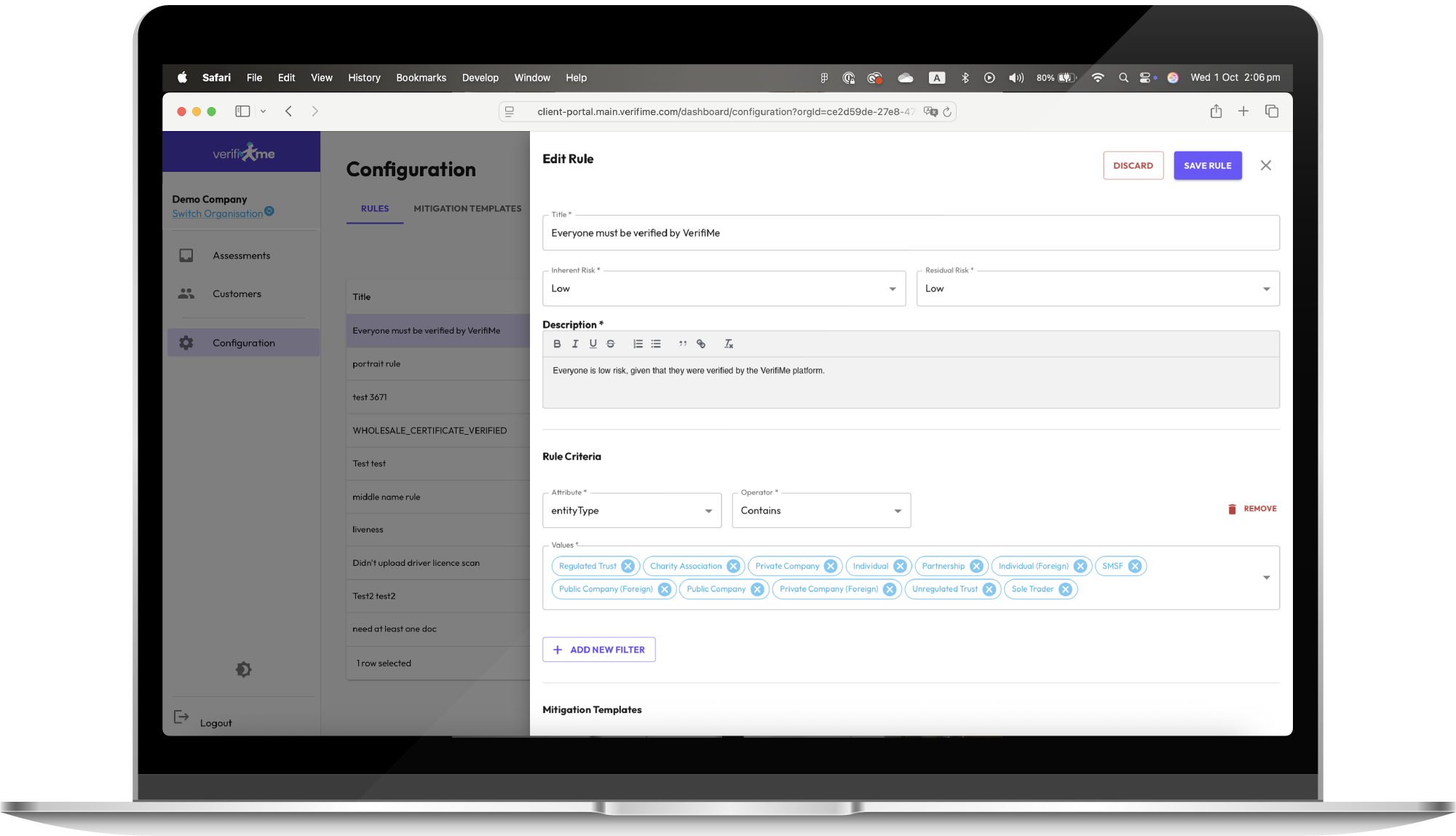

Step 1: Configure Your Compliance Rules

Set up risk categories and compliance policies that match your regulatory requirements. Define assessment criteria, mitigation templates, and your risk appetite—build the foundation for automated decision-making.

-

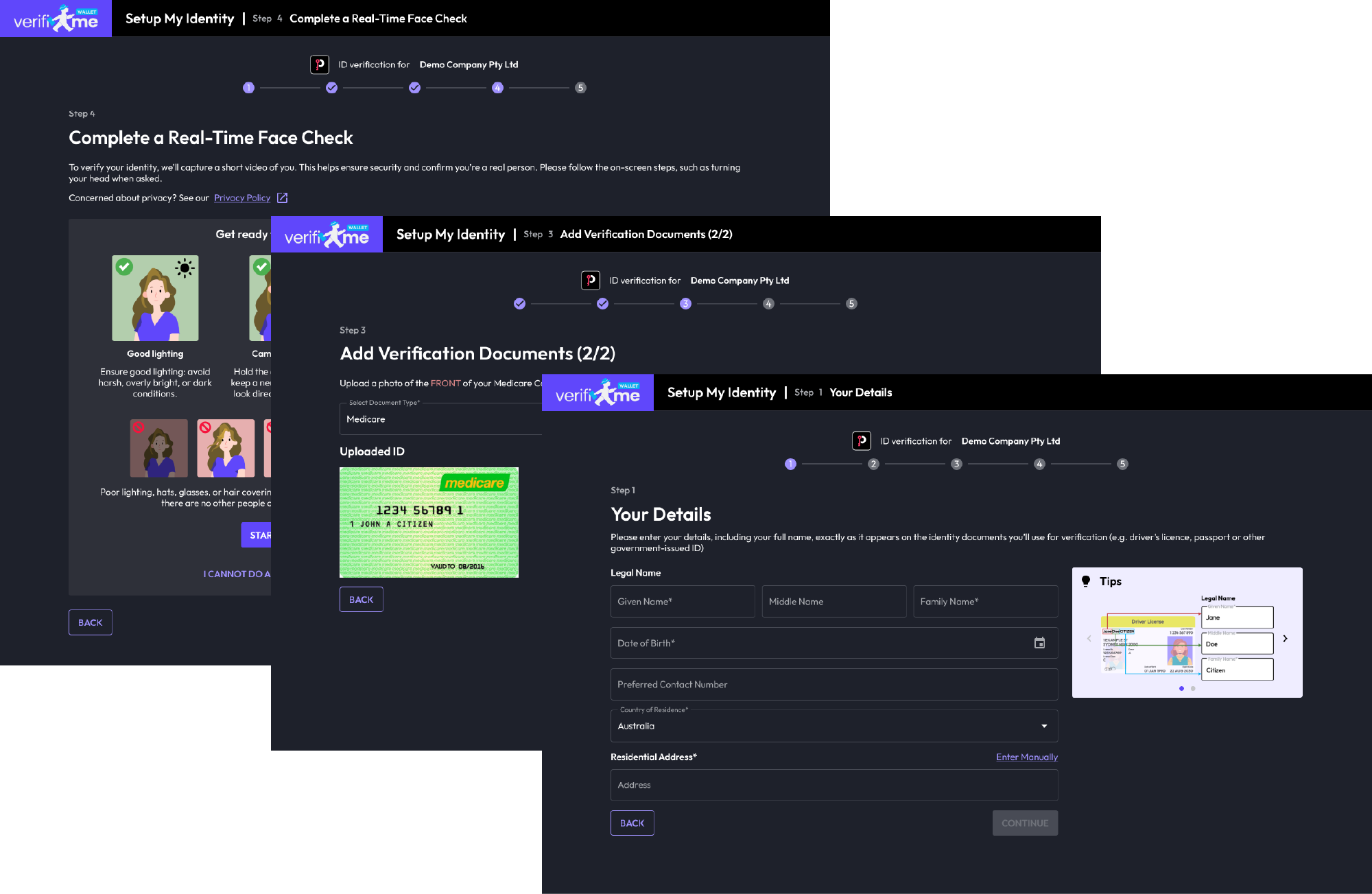

Step 2: Design Your Onboarding Workflow

Map what data you need for each customer type and choose collection methods. Configure VerifiMe's KYC/KYB orchestration to gather documents and assess risk automatically.

-

Step 3: Assess and Audit with Confidence

Evaluate customers against your risk rules, monitor for changes, and generate compliant reports. Every decision is documented with a complete audit trail for regulators.

AML/CTF Tranche 2: Frequently Asked Questions for Accounting Practices

-

From 1 July 2026, Australian accounting practices providing designated services must comply with AML/CTF Tranche 2 requirements.

-

If you provide any of these services, you become a reporting entity:

Buying and selling real estate

Managing client money, securities, or other assets

Managing bank, savings, or securities accounts

Organizing contributions for company formation, operation, or management

Creating, operating, or managing trusts and companies

Standard tax return preparation and bookkeeping services alone typically don't trigger these requirements.

-

Not quite. TPB compliance provides an excellent foundation, but AML/CTF adds specific requirements:

Formal risk classification systems (low/medium/high)

Beneficial ownership mapping beyond client representatives

PEP and sanctions screening

Source of wealth/funds verification for high-risk clients

Ongoing transaction monitoring

Mandatory reporting to AUSTRAC (SMRs and TTRs)

-

Most likely! Your TPB verification satisfies many AML/CTF requirements when:

Your DVS verification meets identity confirmation standards

Authority documentation covers representative verification

Record-keeping provides audit trail foundation

Risk assessment aligns with AML/CTF methodology

You'll need to add: formal risk classification, PEP/sanctions screening, enhanced due diligence procedures, broader beneficial ownership mapping, ongoing monitoring systems, and reporting capabilities.

-

CDD is the process of identifying and verifying your client's identity, understanding their ownership structure, assessing their money laundering/terrorism financing risk, and monitoring the relationship throughout its duration.

-

A PEP is an individual who holds or has held a prominent public function. This includes heads of state, senior politicians, senior government officials, judicial or military officials, senior executives of state-owned corporations, and important political party officials.

-

Three main reports:

Suspicious Matter Reports (SMRs): When you suspect money laundering, terrorism financing, sanctions breaches, fraud, or unusual transactions

Threshold Transaction Reports (TTRs): When you receive AUD $10,000 or more in cash or cash equivalent in a single transaction

Annual AML/CTF Compliance Report: Due 31 March annually, covering the previous calendar yearem description

-

Not necessarily. If your existing TPB verification meets AML/CTF standards, you can leverage that work. However, you'll need to add risk classification, PEP/sanctions screening, and beneficial ownership mapping for clients receiving designated services.

-

Non-compliance can result in significant penalties from AUSTRAC, including substantial fines, enforcement actions, and potential criminal liability for serious breaches.

-

Not with shareable credentials. If your client's identity is verified once through a compliant system like VerifiMe, those verified credentials can be securely shared with their accountant, lawyer, mortgage broker, and financial advisor—eliminating duplicate verification.

-

While you could manage compliance manually, most practices will benefit from dedicated AML/CTF compliance software that automates risk assessment, PEP/sanctions screening, ongoing monitoring, and reporting.

-

VerifiMe automatically maps your existing TPB verification to AML/CTF requirements, adds the additional screening and risk assessment needed, and creates audit-ready documentation for both frameworks—all without re-verifying clients.

Still have questions? Contact VerifiMe (hello@verifime.com) for a consultation to discuss your specific practice requirements and how we can support your AML/CTF Tranche 2 compliance journey.

Disclaimer: The content on this website is general and is not legal advice. Before you make a decision or take a particular action based on the content on this website, you should check its accuracy, completeness, currency and relevance for your purposes. You may wish to seek independent professional advice.

Ready to get compliant for Tranche 2

Get in touch today to see how joining the VerifiMe® network can transform your business.