Transforming Digital Identity Verification and Compliance

Putting customers in control of their identity while solving Australia’s compliance challenges

Our Story

VerifiMe® was born from frustration. Not the kind that leads to complaints, but the kind that sparks innovation.

Working together at Automic Group, our three founders witnessed the same problem repeatedly: customers were forced to prove their identity over and over again to different organisations. Every new bank account, insurance policy, or financial service required the same documents, the same forms, the same invasive process. Meanwhile, businesses struggled with compliance burdens, data security risks, and poor customer experiences.

Alistair McKeough, our Executive Chair, has spent over 20 years helping Australian businesses navigate regulatory complexity. After co-founding and building Whittens & McKeough into Australia's largest outsourced company secretarial business for ASX-listed entities, he understood that compliance didn't have to be painful—it just needed to be reimagined.

Paul Timms, our CEO, brings deep experience from WageSafe, Automic, and Boardroom, where he specialised in regulatory technology and customer experience. He'd seen first hand how broken identity processes frustrated customers and created unnecessary risks for businesses.

Blake Stelzer, our Product Lead and former Chief Operating Officer at Automic, possesses the technical expertise to build scalable solutions that could transform how compliance actually works.

Together, they recognised a fundamental opportunity: What if customers could prove their identity once, then securely share those verified credentials whenever needed? What if businesses could meet their AML/CTF obligations without repeatedly asking customers for the same information? What if privacy and compliance could work together instead of against each other?

That vision became VerifiMe®—Australia's first customer-controlled compliance solution that puts individuals in charge of their own verified digital identity.

The Problem We’re Solving

-

The Current Reality

FOR CUSTOMERS:

Repeatedly providing the same documents

Long, frustrating onboarding processes

Privacy concerns about data storage

Digital exclusion for complex situations

FOR BUSINESSES:

Rising compliance costs and complexity

Customer abandonment during onboarding

Data security and storage risks

Manual, error-prone processes

-

The VerifiMe® Way

FOR CUSTOMERS:

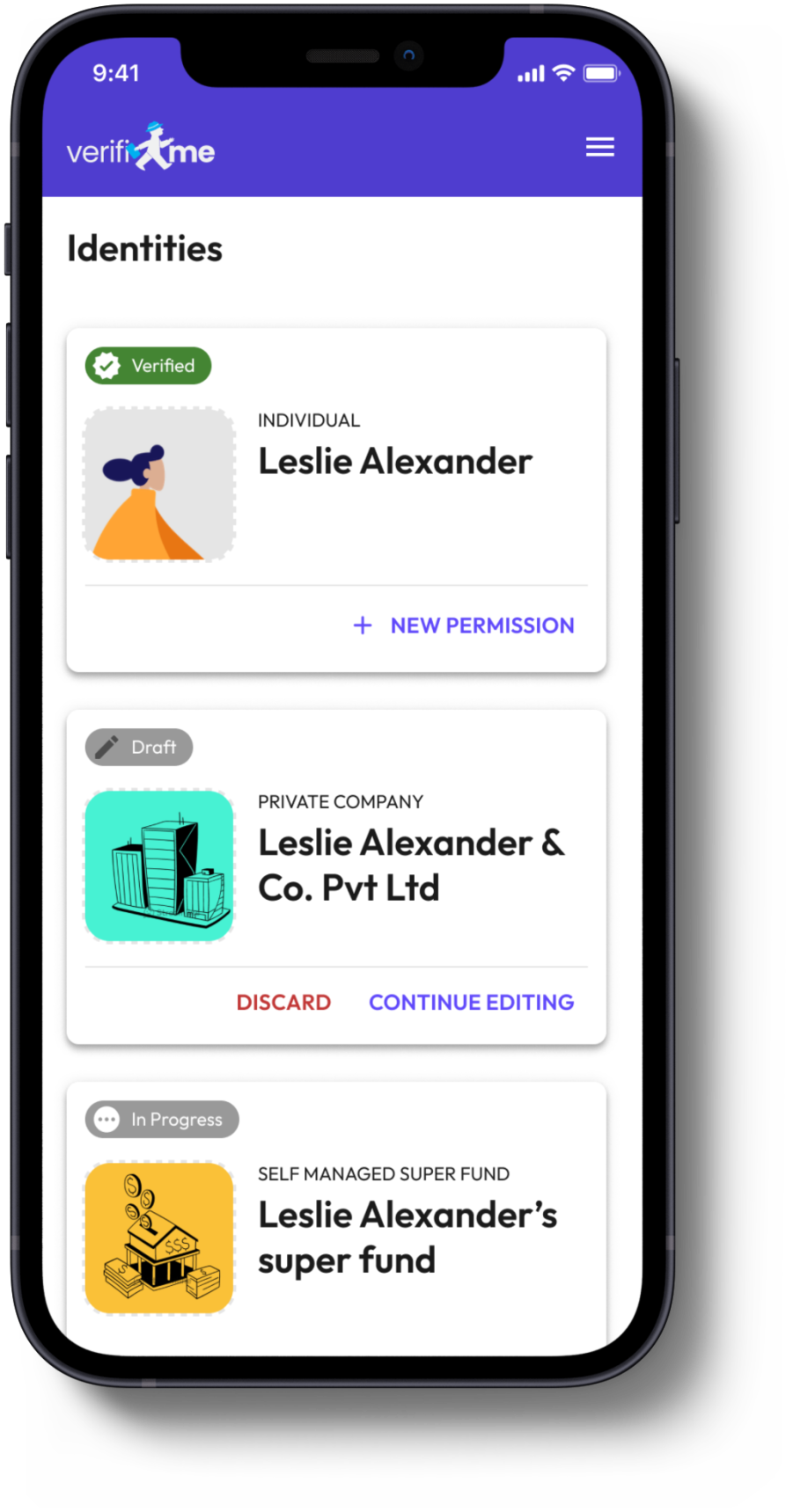

Verify once, share everywhere securely

Two-click identity sharing

Complete control over personal data with active consent and permissions

Seamless digital experience

FOR BUSINESSES:

Automated AML/CTF compliance

Higher conversion rates

Reduced data liability

Configurable risk assessments

Mitigation risk management

Meet the team that is on a mission to revolutionise how personally identifiable information is managed and shared

-

Alistair McKeough

FOUNDER & CHAIR

-

Paul Timms

FOUNDER & CEO

-

Blake Stelzer

FOUNDER & PRODUCT LEAD

-

Charles Jiang

CHIEF TECHNOLOGY OFFICER

-

Ipsa Mehta

HEAD OF PRODUCT & DESIGN

-

Zoe McKeough

HEAD OF SPECIAL PROJECTS

-

Dingyuan Liu

SENIOR FRONT-END ENGINEER

-

Karen Chan

Operations Manager

VerifiMe®: A network that has solved identity sharing.

Get in touch today to see how joining the VerifiMe® network can transform your business.

FAQ VerifiMe - Compliance SaaS

All the checks you need, for any regulation, market or use case.

Customer due diligence compliance and fraud protection aren’t one-size-fits-all. Get the solution that fits your needs today and deliver a positive customer outcome. Have a question check out the FAQ below.

-

Most firms complete basic setup in 1-2 days. You'll configure your risk rules, design onboarding workflows, and connect any existing systems. More complex implementations with custom integrations typically take 1-2 weeks

-

No. Our platform is designed for compliance and operations teams. You configure rules and workflows through an intuitive interface—no coding required. Our team provides onboarding support to help you get started.

-

Absolutely. VerifiMe is built for flexibility. You define your own risk categories, assessment criteria, data collection requirements, and mitigation workflows. The platform adapts to your policies, not the other way around.

-

You can update your rules, workflows, and data collection requirements anytime without rebuilding from scratch. This is critical as Tranche 2 regulations evolve and AUSTRAC guidance develops.

-

VerifiMe is built specifically for Australian AML/CTF requirements, including the upcoming Tranche 2 reforms. We support AUSTRAC reporting, PEP and sanctions screening, customer due diligence, enhanced due diligence, and reporting.

-

You define customer categories based on your business—individuals, trusts, companies, SMSFs, wholesale investors, etc. Each category can have different data requirements, risk thresholds, and verification workflows.

-

Built-in. VerifiMe automatically screens against global sanctions lists and PEP databases as part of your onboarding and ongoing monitoring workflows.

-

After verification, customers receive tokenized credentials they control. When engaging with another reporting entity using VerifiMe, they can consent to share their verified identity—eliminating duplicate verification while maintaining privacy and control.

-

We verify government IDs (driver's licenses, passports, Medicare cards), proof of address documents, business registrations, trust deeds, financial statements, wholesale investor certificates, and more. You configure what's required for each customer type.

-

Yes. VerifiMe's flexible data collection lets you gather any information required by your risk assessment—beneficial ownership structures, source of funds/wealth, business activities, or industry-specific requirements.

-

VerifiMe evaluates collected data against the risk rules you've configured. The platform automatically calculates risk scores, flags high-risk indicators, and recommends mitigation actions based on your policies.

-

Absolutely. While automation handles routine assessments, compliance officers can review, override, or escalate any decision. All manual interventions are logged in the audit trail.

-

Yes. VerifiMe offers API integration with practice management software, CRMs, accounting platforms, and document management systems. We work with common platforms used by accountants, lawyers, and fund managers.

-

VerifiMe addresses all key Tranche 2 requirements: customer identification and verification, beneficial ownership identification, ongoing customer due diligence, risk assessment and mitigation, PEP and sanctions screening, record-keeping and reporting, and suspicious matter identification.

-

VerifiMe's flexible configuration means you can adapt your workflows as regulations and AUSTRAC guidance evolve, without vendor dependency or expensive redevelopment.

-

Yes. We offer demonstrations and can arrange pilot programs to ensure VerifiMe meets your specific requirements.

Contact Us

Hours

Monday–Friday

8.30 am–5.30 pm

Address

L5, 137-139 Bathurst Street, Sydney, NSW 2000

Phone

+61 2 7208 9555

support@verifime.com