KYC, AML/CTF compliance & Identity Verification Reimagined

The only platform where customers own their verified identity and share it on their terms. No document storage. No privacy risks. Full AUSTRAC compliance.

The Problem with Traditional KYC

Every business asks for the same documents. Customers get frustrated.

You store sensitive documents – creating massive data breach liability

Clients verify repeatedly – with every accountant, lawyer, and agent they work with

Manual processes – can't scale to meet July 2026 deadline

Generic platforms – not designed for Australian professional services context

VerifiMe® Australias First Shareable Identity Solution

The difference? Your customers own their verified credentials, storing them securely for instant reuse across service providers. One verification, endless applications.

Verify once, reuse forever

Clients control sharing across all service providers

Keep customer data secure

You receive verified attestations, not raw data.

Global document support

Thousands of ID types verified. Australian data sovereignty guaranteed.

Automated workflows

Automated risk assessments tailored to your industry requirements. Trance 2-ready.

Built for Professional Services, Designed for Tranche 2

-

Accountants

Meet TPB and AUSTRAC obligations with shareable credentials. One client verification, infinite reuse

-

Fund & Asset Managers

Revolutionise your AML/CTF and ASIC requirements for customer due diligence.

-

Lawyers

Protect legal professional privilege while meeting customer Tranche 2 requirements

-

Real Estate Agents

Verify sellers and buyers faster, minimise privacy risks and be Tranche 2 ready

-

Everyone else

No matter your size, if you need to collect and verify personally identifiable information, we can help.

Trusted by Australia’s Leading Firms

-

"We have worked with the VerifiMe team to set up an ID verification process across stores in NSW, QLD and VIC. The process for customers is quick and easy."

Tony Vuong, Head of Operations, Kennards Self Storage

-

“ VerifiMe’s seamless verification solution saves time and eliminates the need to handle personally identifiable information. Highly recommended."

Victoria-Jane Otavski, Partner Blackbay Lawyers

-

“ Their understanding of regulatory compliance, support and the technology provided was exceptional."

Anthony Hersch CEO, Law Capital

-

"The VerifiMe team and platform have been instrumental in helping us achieve our AML-CTF objectives and stay up-to-date with wholesale investor compliance."

Renee Hetreles, Finance and Compliance Leftfield Capital Partners

-

"The platform’s efficiency in verifying clients and their agents has significantly streamlined our process"

Daniel Spears, Principal at Dunamis Advisory

-

“We found VerifiMe very easy to implement and allows us to meet our compliance objectives efficiently and cost effectively."

Sebastian Garufi, Garufi McDonald Chartered Accountant

Get Compliant. Start Now With 3 Easy Steps

-

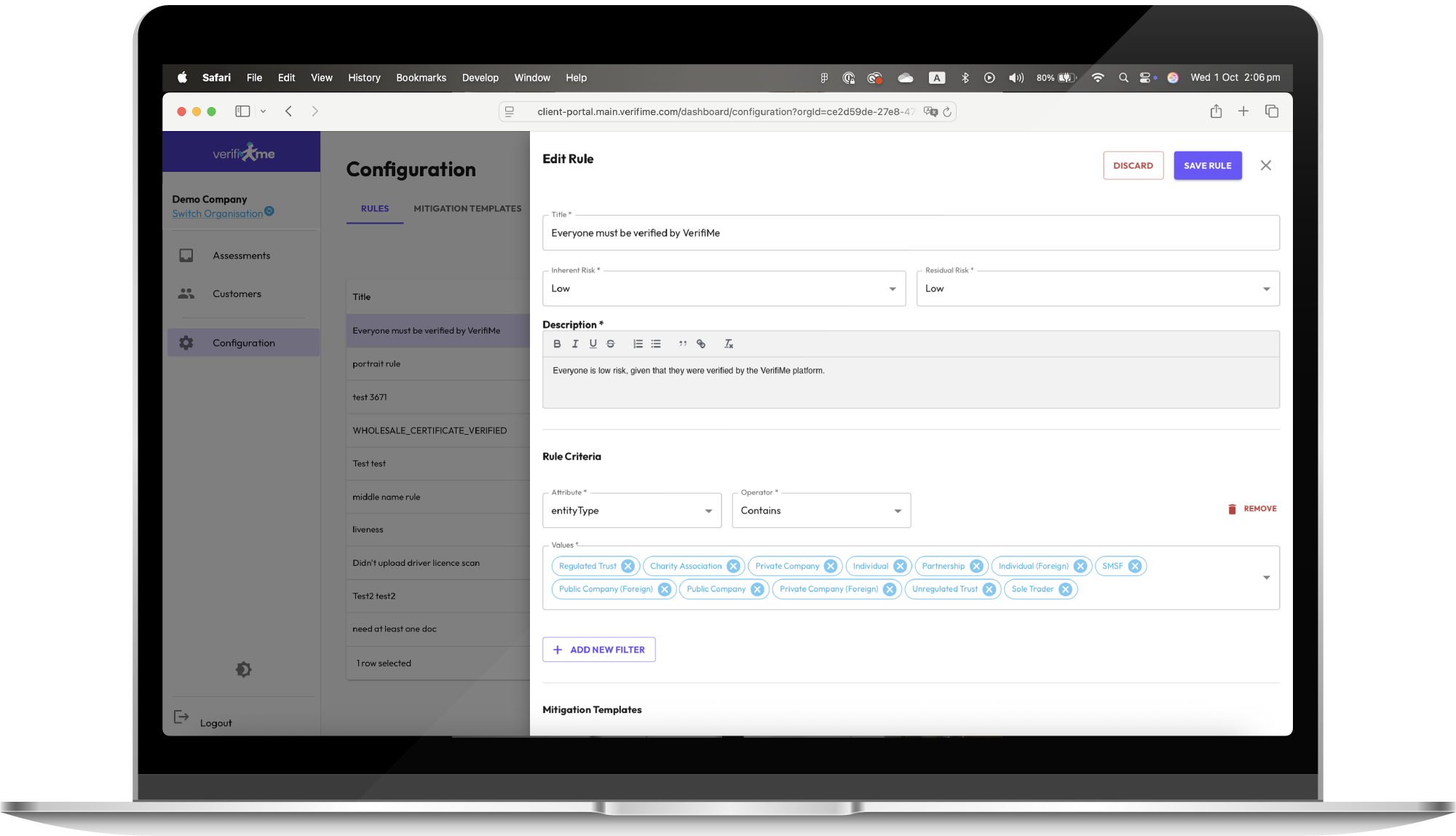

Step 1: Configure Your Compliance Rules

Set up risk categories and compliance policies that match your regulatory requirements. Define assessment criteria, mitigation templates, and your risk appetite—build the foundation for automated decision-making.

-

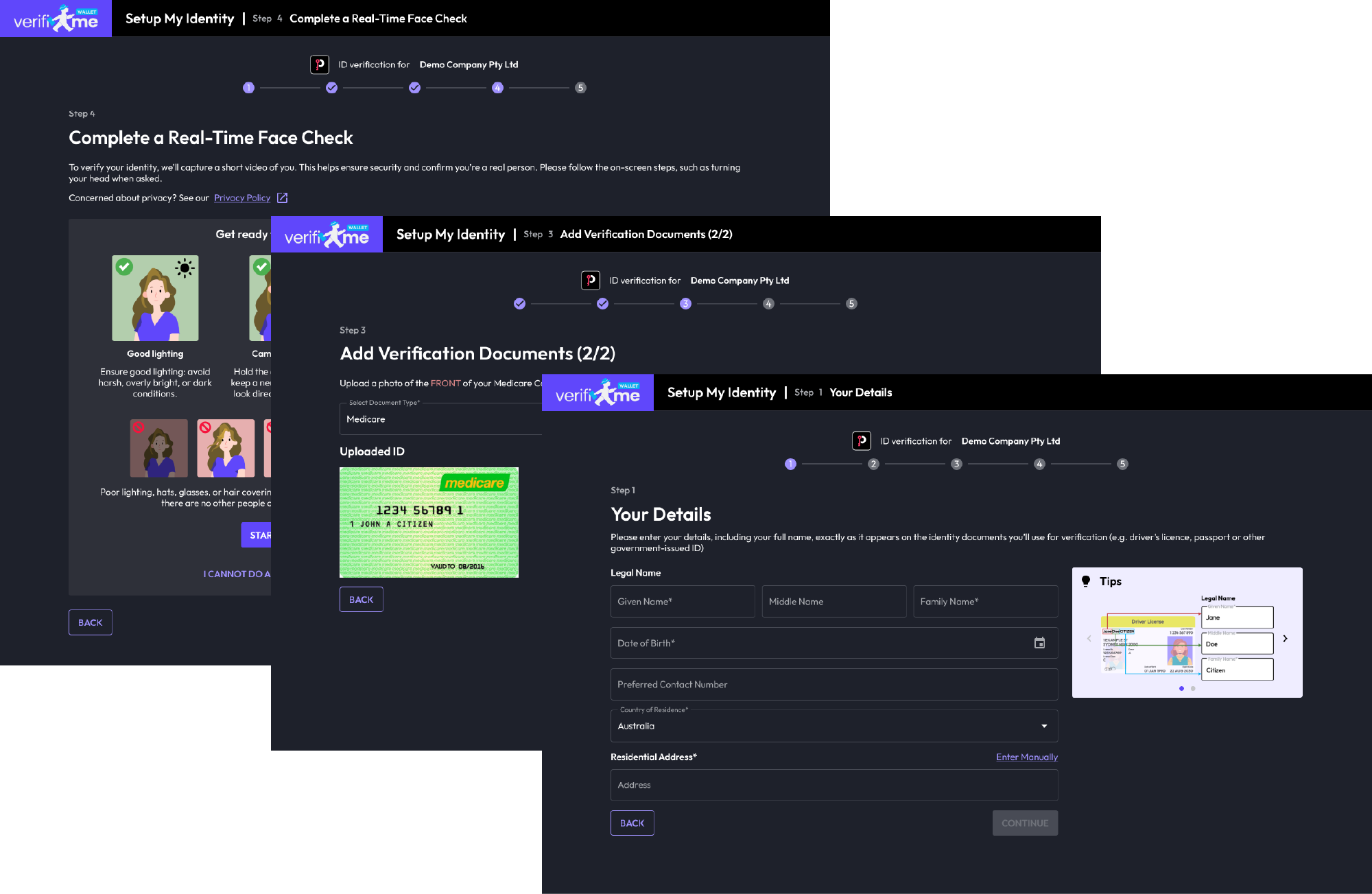

Step 2: Design Your Onboarding Workflow

Map what data you need for each customer type and choose collection methods. Configure VerifiMe's KYC/KYB orchestration to gather documents and assess risk automatically.

-

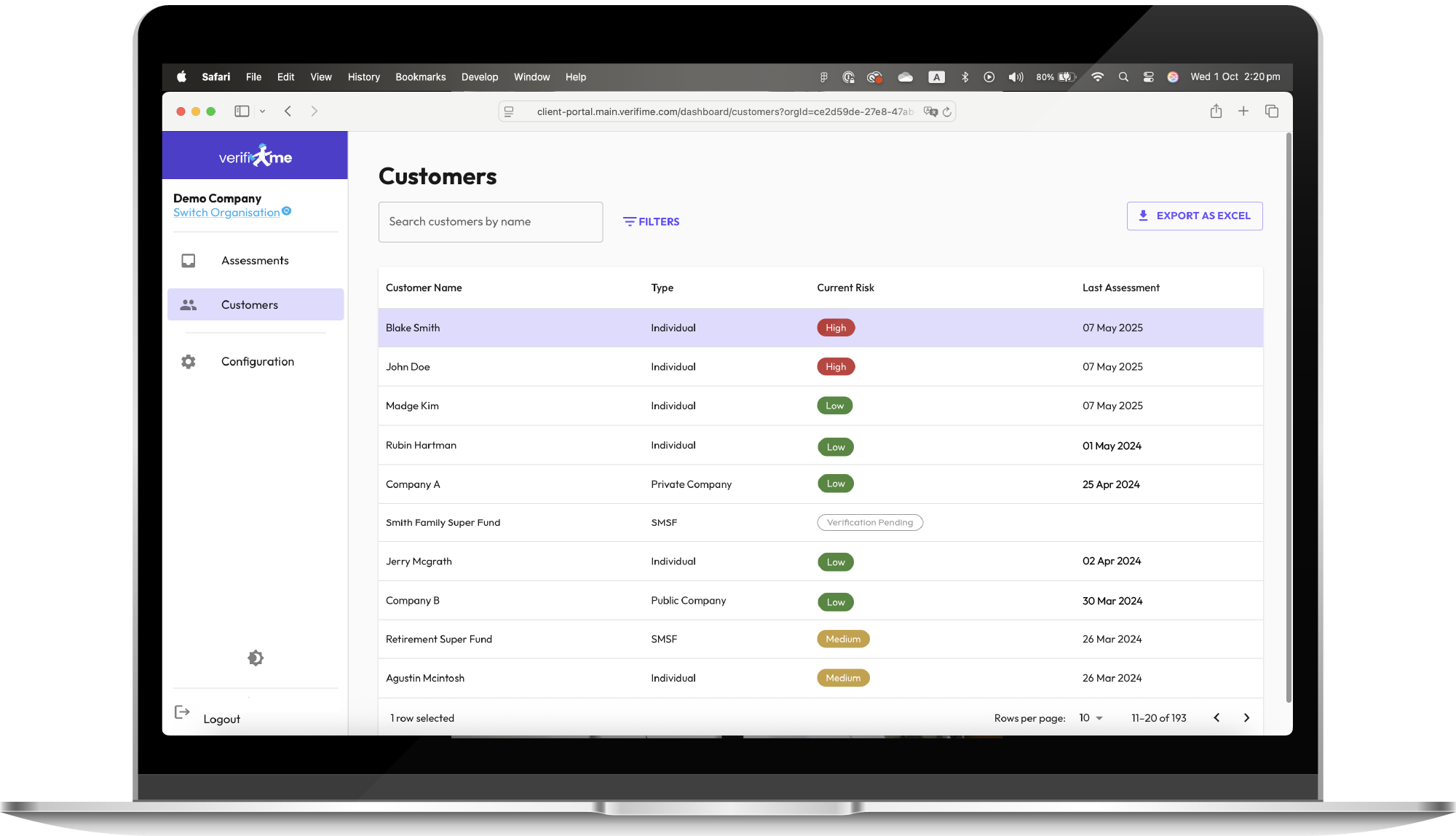

Step 3: Assess and Audit with Confidence

Evaluate customers against your risk rules, monitor for changes, and generate compliant reports. Every decision is documented with a complete audit trail for regulators.

Finally a KYC & Identity Verification Solution that Empowers Customers and Businesses

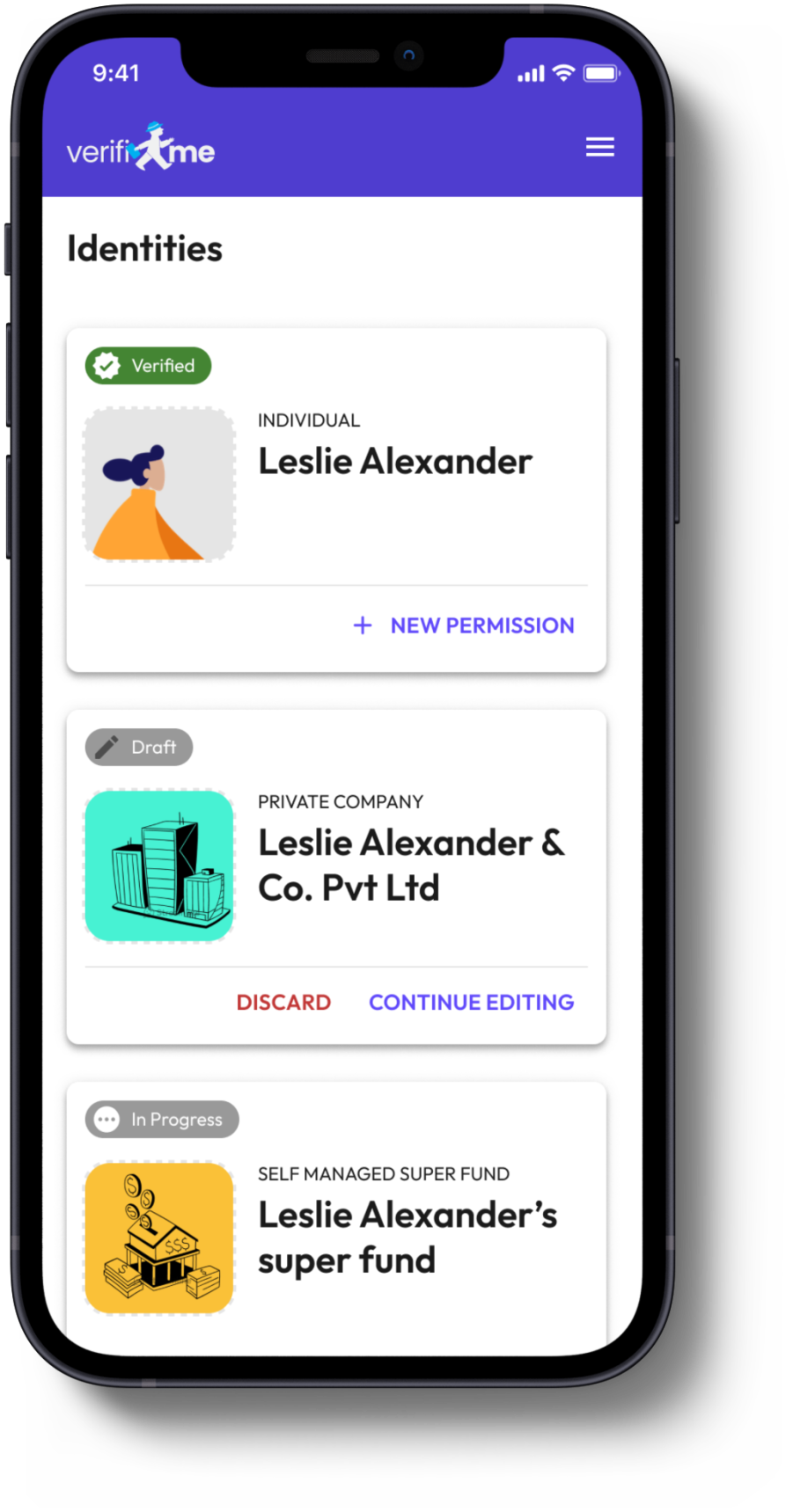

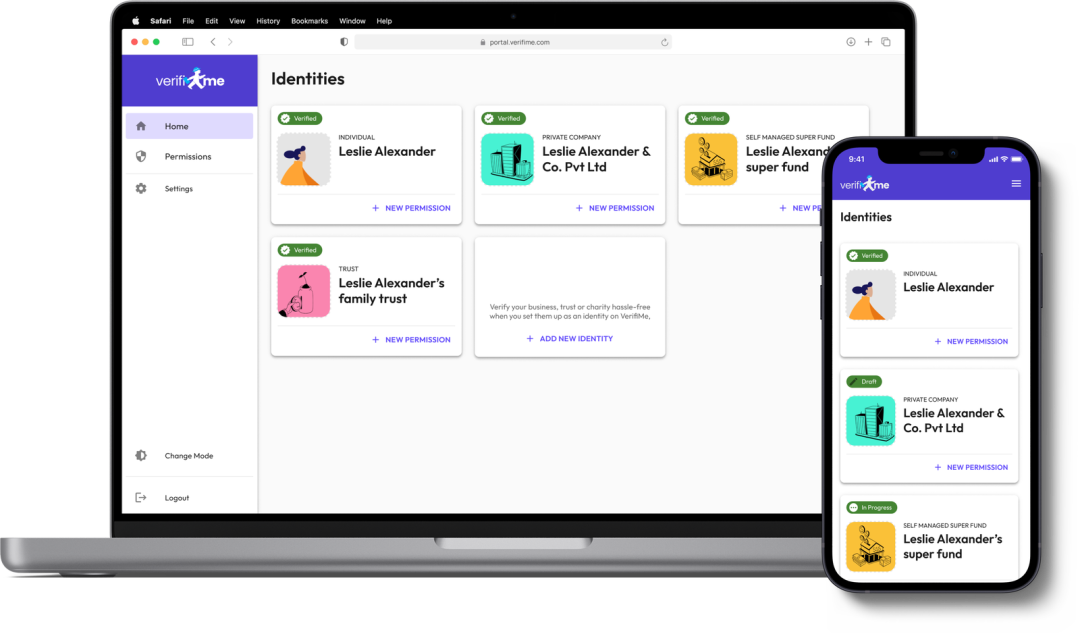

VerifiMe® for

your customers

Break free from asking your customers to repeatedly fill out forms and share documents of personal information.

Use VerifiMe to allow your customers to prove who they are without risk of exposing their personal information. They can also use it to verify their SMSF, trust or company. It’s free to use and simple to set up.

VerifiMe® for

your business

Elevate your customer experience and trust while minimising compliance and data security risks.

Automated customer acquisition, that is tailored to your rules. Helps you acquire customers and meet your rules of KYC and AML/CTF compliance now and in the future.

Insights

VerifiMe Platform FAQ

Getting Started

How long does it take to set up VerifiMe?

Most firms complete basic setup in 1-2 days. You'll configure your risk rules, design onboarding workflows, and connect any existing systems. More complex implementations with custom integrations typically take 1-2 weeks.

Do I need technical expertise to configure VerifiMe?

No. Our platform is designed for compliance and operations teams. You configure rules and workflows through an intuitive interface—no coding required. Our team provides onboarding support to help you get started.

Can I customise the platform to match our specific risk appetite?

Absolutely. VerifiMe is built for flexibility. You define your own risk categories, assessment criteria, data collection requirements, and mitigation workflows. The platform adapts to your policies, not the other way around.

What if our compliance requirements change?

You can update your rules, workflows, and data collection requirements anytime without rebuilding from scratch. This is critical as Tranche 2 regulations evolve and AUSTRAC guidance develops.

Risk & Compliance Configuration

What compliance frameworks does VerifiMe support?

VerifiMe is built specifically for Australian AML/CTF requirements, including the upcoming Tranche 2 reforms. We support AUSTRAC reporting, PEP and sanctions screening, customer due diligence, enhanced due diligence, and suspicious matter reporting (SMR).

Can we use our existing risk assessment framework?

Yes. VerifiMe lets you upload and implement your existing compliance policies. You can map your current risk categories, assessment criteria, and mitigation procedures directly into the platform.

How does VerifiMe handle different customer types?

You define customer categories based on your business—individuals, trusts, companies, SMSFs, wholesale investors, etc. Each category can have different data requirements, risk thresholds, and verification workflows.

What about PEP and sanctions screening?

Built-in. VerifiMe automatically screens against global sanctions lists and PEP databases as part of your onboarding and ongoing monitoring workflows.

Onboarding & Data Collection

Can customers verify once and reuse their identity?

Yes—this is VerifiMe's key differentiator. Customers verify once and receive a shareable identity credential in their digital wallet. They can then share verified information with other VerifiMe-connected organisations without re-verifying, dramatically reducing friction.

How does the shareable identity wallet work?

After verification, customers receive tokenised credentials they control. When engaging with another reporting entity using VerifiMe, they can consent to share their verified identity—eliminating duplicate verification while maintaining privacy and control.

What documents can VerifiMe verify?

We verify government IDs (driver's licenses, passports, Medicare cards), proof of address documents, business registrations, trust deeds, financial statements, wholesale investor certificates, and more. You configure what's required for each customer type.

Can we collect additional information beyond standard KYC?

Yes. VerifiMe's flexible data collection lets you gather any information required by your risk assessment—beneficial ownership structures, source of funds/wealth, business activities, or industry-specific requirements.

Assessment

How does automated risk assessment work?

VerifiMe evaluates collected data against the risk rules you've configured. The platform automatically calculates risk scores, flags high-risk indicators, and recommends mitigation actions based on your policies.

Can compliance officers override automated decisions?

Absolutely. While automation handles routine assessments, compliance officers can review, override, or escalate any decision. All manual interventions are logged in the audit trail.

How does ongoing monitoring work?

VerifiMe can continuously monitor for PEP/sanctions list changes, adverse media, registry updates, transaction patterns (if integrated), and periodic re-verification triggers based on your risk policies.

Integration & Technical

Does VerifiMe integrate with our existing systems?

Yes. VerifiMe offers API integration with practice management software, CRMs, accounting platforms, and document management systems. We work with common platforms used by accountants, lawyers, and fund managers.

What about data security and privacy?

VerifiMe uses bank-grade encryption, Australian data hosting, role-based access controls, and privacy-by-design principles. We're compliant with Privacy Act requirements.

Can we use VerifiMe across multiple offices or entities?

Yes. You can configure different workflows and rules for different business units, offices, or related entities while maintaining centralised reporting and oversight.

Tranche 2 Specific

How does VerifiMe prepare us for Tranche 2 AML/CTF reforms?

VerifiMe addresses all key Tranche 2 requirements: customer identification and verification, beneficial ownership identification, ongoing customer due diligence, risk assessment and mitigation, PEP and sanctions screening, record-keeping and reporting.

When should we start implementing for the July 2026 deadline?

Now. With approximately 90,000 new reporting entities needing compliance solutions, implementation timelines will extend as the deadline approaches. Starting early gives you time to refine workflows, train staff, and ensure smooth operations before enforcement begins.

What if Tranche 2 regulations change before July 2026?

VerifiMe's flexible configuration means you can adapt your workflows as regulations and AUSTRAC guidance evolve, without vendor dependency or expensive redevelopment.

Try before buying

Can we trial VerifiMe before committing?

Yes. We offer demonstrations and can arrange pilot programs to ensure VerifiMe meets your specific requirements.

Don’t Wait Until June 2026?

Join Australian firms preparing now for Tranche 2. Get your AML/CTF Program operational months before the deadline.

Learn more about VerifiMe® , by requesting a demonstration or check out our Blog.

Click on the Explore Product link to understand the advantages of VerifiMe® compared to other identity/KYC verification service providers.

Understand what made our Australian founders embark on this mission - click here